As a Charitable Organisation, As a Fundraiser

– Does your organisation have fundraising opportunities abroad?

– Does the cause you serve know no boundaries?

– Are your potential donors abroad interested in tax effective giving?

– Do you wish to extend fundraising beyond your national borders, but miss the local branch network to handle the gifts?

Benefits for Charitable Organizations:

Europe-wide Opportunities to Mobilize Resources

By providing a secured and tax-effective cross-border giving framework, TGE builds a bridge between your organization and prospective donors abroad. Receiving tax-free contributions from foreign donors, appealing to expatriates, approaching global partners such as multinational corporations, benefiting from borderless interest in your cause or capitalizing on global exposure offered by an online network. is within arm’s reach. The TGE network does not raise money on behalf of your organisation, but enables you to make the most of fundraising opportunities available to your organisation in as many European countries as possible.

Please note that TGE is not intended to be used for massive fundraising campaigns using promotional data acquired through the purchase, rental or exchange of data or using important media campaigns. Beneficiaries using TGE should respect ethical principles agreed by the network in their communication towards donors at all times.

National Fiscal Incentives to Charitable Giving

Once approved as an eligible recipient of transnational gifts by TGE, your organisation will benefit from fiscal incentives to charitable giving provided for by national regulations in the same way as domestic charities. Supporting your organisation will yield the same tax benefits for foreign donors as supporting non-profit organisations in their home country.

Expertise in National Tax Laws

TGE enables your organisation to extend fundraising to foreign countries, without having to set up branches or sister organisations for that sole purpose and without having to master different national laws. TGE offers you the comfort of relying on a support infrastructure managed by leading national foundations, with experience in tax laws and the non-profit sector in their respective home countries. Tax questions from prospective donors, gift procedures and donations to your organisation will be handled by TGE partners, ensuring a global approach and the most effective tax treatment for donors, whether individuals or corporations.

Administrative tasks taken care of for you

TGE carries out all administrative tasks related to the tax deductibility of gifts. Depending on the country’s tax laws, TGE partners will fill in all relevant tax forms and deliver, whenever applicable, fiscal receipts testifying to the contribution made.

Operational Costs

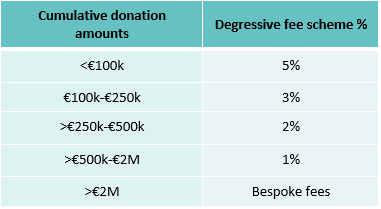

The TGE network retains a contribution on the cross-border gifts channeled. This contribution supports the development of the network through activities such as digital development, finding new partner foundations or providing free practical information on philanthropy in Europe. The aim is to increase tax effective giving across Europe and accelerate the establishment of a single market for philanthropy.

A 5% contribution is applied on gifts up to 100.000 euros (or the equivalent in another currency), with a degressive fee structure on the donated amount above this mark.

For more information, please get in touch with your national TGE partner.

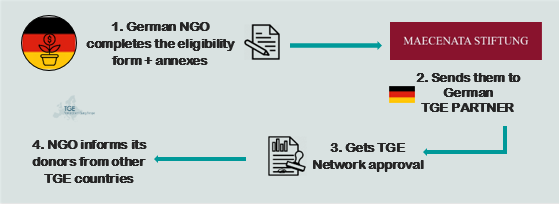

Procedure for a beneficiary organisation:

As an organisation with donors abroad and wanting to provide them with a tax efficient solution for their donations, you should:

- Contact the TGE partner in your country.

- You will be asked to fill in the TGE Grant Eligibility Application Form(GEAF) and send it back to the TGE national partner for approval together with some documents. Once a beneficiary is declared eligible, he will receive the practical details on how donors can make their donations.

Donors will then be able to transfer the money (national transaction) to their national partner’s bank account who will provide with a fiscal receipt deductible for national tax purpose. The TGE network will then take care of the international transaction of the gift to the final beneficiary, avoiding gift taxes.