As an individual or corporate Donor

– Are you aware of a cause or organisation outside your home country, which you would be keen to support?

– Are you interested in tax effective cross-border giving?

– As an expatriate, would you like to continue to help the charity you used to in your country of origin in a tax-efficient way?

– Are you concerned about making gifts to quality projects and organisations?

– As a multinational, would you like to hear about flexible and tax effective global corporate giving?

Benefits for Donors:

Reliable Framework

TGE offers the comfort of a network of prominent grant-making foundations, anchored in each of the countries covered, where they have outstanding relationships with most non-profit organisations and enjoy the confidence of national authorities. They ensure your contribution is allocated to the foreign charitable organisation you have chosen to support.

Quality Review of Beneficiaries

TGE partners’ long-standing experience as grant-makers and intimate knowledge of the non-profit sector in their home country serve your generosity. Their involvement with your gift is your guarantee of the quality of the project and organisation you wish to support.

Tax Effective Cross-Border Giving

Your cross-border donation receives all applicable tax benefits in the country where you pay tax. The Partner foundations’ combined expertise in domestic tax laws secures the most effective tax treatment for your gift in both your own country and the recipient’s.

Flexible and Effective Global Giving Management

TGE enables multinational corporations to freely organise their philanthropic giving to best suit their business strategy and community involvement policy, without having to master different tax laws and national regulations. Created opportunities include centralising all philanthropic giving out of most favourable tax jurisdiction and in accordance with corporate profits, or setting up joint corporate campaigns involving individual contributions by local branches and employees.

Simple and Standard Procedure

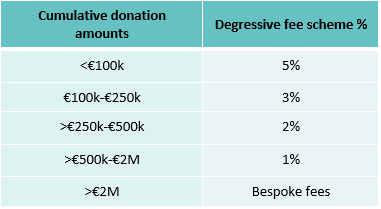

A single counterpart – your national foundation, a national phone call or mail in your mother tongue and a regular domestic payment to make gifts to beneficiaries in any of the eligible countries. TGE keeps you informed throughout the procedure and carries out required formalities for tax relief. A 5% contribution is applied on gifts up to 100.000 euros (or the equivalent in another currency), with a degressive fee structure on the donated amount above this mark.

For information on making large donations, you can contact your national TGE partner. Banking fees are invoiced when actually incurred.

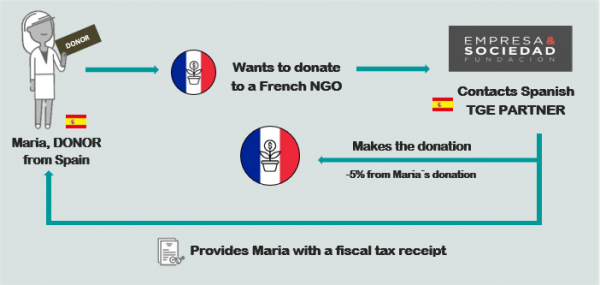

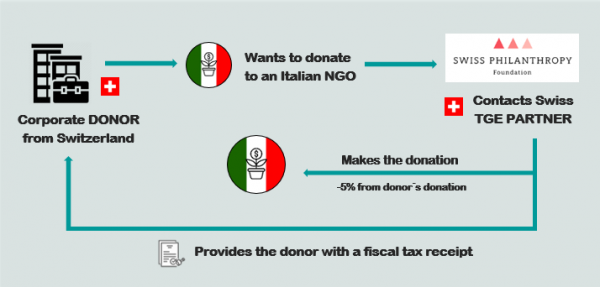

Procedure for a donor wanting to use TGE

As a donor resident in one of the participating countries and wishing to make a gift to a public interest organisation in one of the other member countries, you should:

- Contact the partner foundation in the country of your residence (read the gift conditions of your country below.)

- Your national foundation will establish contact with the beneficiary organisation and the foundation in the recipient country to inform them of the incoming donation.

- If the beneficiary organisation is not yet registered in the network they must do so prior to receiving donations. (please read http://www.transnationalgiving.eu/beneficiaries)

If the evaluation is positive, the donor makes the gift to his home-country foundation which then provides the donor with a tax receipt and transfers the gift to the beneficiary organisation.

Example: Donation from a Spanish donor to a French NGO

Example: Corporate donation from a Swiss donor to an Italian NGO

*Contribution to TGE

The TGE network retains a contribution on the cross-border gifts channeled. This contribution supports the development of the network through activities such as digital development, finding new partner foundations or providing free practical information on philanthropy in Europe. The aim is to increase tax effective giving across Europe and accelerate the establishment of a single market for philanthropy.

For more information, please get in touch with your national TGE partner.